Insurance Agents Need A J.A.R.V.I.S (Just A Rather Very Intelligent System)

- Sumanas Kar Regional Director India & South Asia Vymo Technologies

- May 24, 2024

- 5 min read

Regulatory complexities, increased competition, and a diverse set of offerings have made the insurance landscape complex. Changing customer demographics and rapid technological advancements are further compounding these challenges. All eyes are on the insurance industry, evaluating its readiness to remain customer-focused and competitive in these choppy waters. The upside to this is the explosion of data from connected devices and the availability of technology tools that can solve a range of problems.

As insurers reorient their strategy, introduce new products, and enhance their customer experience - let’s consider one often overlooked aspect - the seller experience. What common challenges are insurance agents facing today across multiple distribution channels?

Siloed data - While there is an abundance of data,it resides in multiple systems, across various divisions and branches. To leverage this data and gain insight, sellers (agents) have to access multiple documents from various sources. This increases the complexity of seemingly simple tasks such as building a complete customer profile.

Multiple tools - On average, an agent uses eight to ten different tools throughout their workday: CRM, Zoom, email, phones, note-taking tools, quote-generating software and so on. Switching between systems consumes time and often results in data loss, failing to empower the seller the way it ideally should.

Repetitive, mundane tasks - Most agents input visiting card data, store customer contacts on their phones and notepads, jot down customer conversations in their notebooks and later input these details into clunky systems. Logging activities, data, action points etc., can drain the passion for selling, making the job mundane and repetitive. It is hardly surprising that various studies suggest sellers spend only one-third of their time actually selling, significantly impacting productivity.

As agents face these operational challenges, insurers also grapple with macro challenges as a result of stymied seller productivity. These include:

Market differentiation - As insurers try to gain market share and strengthen their value proposition, they need their agents to excel in their roles. Agents are the brand ambassadors of the insurance company, and their customer engagement is critical. . Legacy systems, inaccurate data, and incomplete customer information can tarnish both reputation and business.

Attrition - The Insurance sector is battling high attrition rates, as high as 40% , increasing the pressure on leaders to devise strategies for recruitment, training and retention. With one in three insurance agents leaving their jobs within the first year, the industry has to explore different ways to retain their agents and provide them with a career path.

Customer experience - The lack of right seller tools and data insight leads to delays in responding to customers, inaccurate personalization, and inefficiencies in resolving customer issues.

Insurers must shift to a more customer-centric business model with technology as an enabler, but seller-centricity should also be an important component of this strategy. Today’s sellers need a lot more than just a CRM - they need an intelligent personal assistant. For instance, Kate Leggett, a Forrester Research Analyst, noted last year on social media how AI-led sales tools are much like Tony Stark’s J.A.R.V.I.S, automating repetitive tasks, providing insights into customer profiles, and helping sellers manage their day effectively to shorten customer conversion cycles and improve engagement. Features of an effective personal sales assistant:

Mobile-first technology - Many agents still jot down notes in their little books, and memorize to-dos, only inputting data into the system after customer meetings, sometimes only at the end of the week. Equipping them with mobile-first technology for on-the-go data input, reminders, alerts, and meeting summaries can provide more comprehensive data in the system, quicker customer responses and less manual data entry.

Single-pane-of-glass view - Mobile-first technology is incomplete if agents cannot perform all their activities through a single interface. Whether it is calling Customer A, finding the exact location of the meeting, receiving a reminder to send a proposal to Customer B, or summarizing meeting action points with the manager,a single app that facilitates all these tasks can be highly efficient and addictive, encouraging agents not only to adopt this technology but also to make it a habit. In fact, Sun Life Financial, one of our largest clients in Asia Pacific, experienced remarkable results after implementing a unified interface for its users. Their teams were able to double the number of engagement activities planned and reduce the average time taken to convert a lead to a customer by over 65%. As a result, the company saw a remarkable 14% increase in the number of new deals closed per agent.

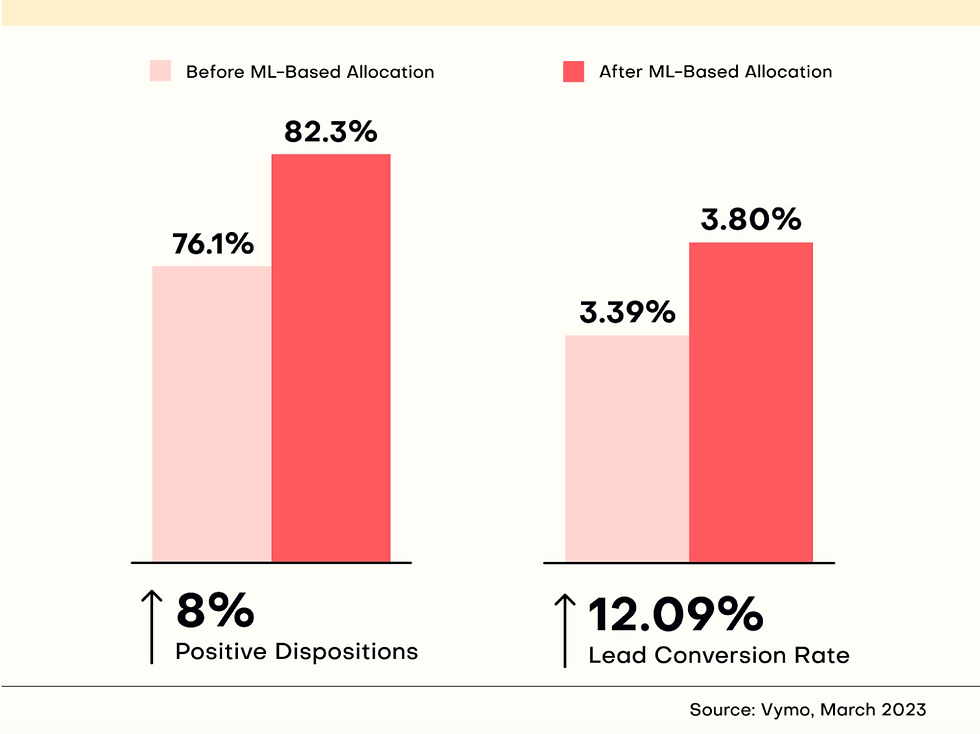

AI and ML-backed technology - Tools that not only track and capture activities and lead information but also analyze data, learn from it, and provide actionable insights can significantly enhance agent effectiveness. For example, ML-based tech can suggest the next best action for an agent based on historical data, recommend products that meet customer needs, and allocate leads to the most suitable agent, increasing the likelihood of conversion. We tested the impact of such technologies in allocating leads to the right agent with one of India’s leading insurance carriers by mapping the client’s rule-based allocation engine to Vymo’s ML-based allocation algorithm. The system not only comprehended lead attributes, but also recognized the actions performed by the lead over time. After a pilot implementation, we observed an 8% jump in positive dispositions from customers who were paired with the right agents. This led to a 12% increase in conversion rates - a significant improvement in terms of actual revenue generated.

The client now has a lighter and more efficient lead allocation system giving their agents a first-mover advantage as they engage with leads that are ideally matched for them. This also boosts the sales engagement process and the overall customer experience; checking all the boxes for the client.

Allows constant learning and updation - AI and ML algorithms are constantly learning from existing data. The best practices from high-performing agents are captured as best practices for newer agents to emulate. AI can nudge agents to take the right actions and enable their managers to intervene at the right time, ensuring that learning is continuous and seamless. This approach does not feel like a cumbersome 30-hour course on a training portal. Not only that, every one of the hundreds of agents in the organization accesses these nuggets of wisdom, allowing them to learn and grow together. On-the-job learning of this nature is easily processed and assimilated. Gordon Ritter, Co-founder, Emergence Capital, recently discussed the next frontier of software, referring to this type of training as ‘Coaching Networks’. He said, “The entire workforce is automatically getting upskilled by the sharing of winning behaviours from the best workers to the rest via a nudge or an intervention. This dynamic, perpetually growing software is very exciting for corporations of all sizes.”

Sales technology that delivers these capabilities should no longer be on an agent’s wishlist - it is now a vital part of their toolkit. Imagine hiring a Gen Z agent who is accustomed to using intuitive apps like Netflix, Uber, and Amazon. Expecting them to work with slow, complex and cumbersome systems is unrealistic. They would likely become frustrated and soon start exploring other roles.

It is time for insurers to build sales technology that supports agents, and provides them with the right ecosystem for building a long-term career in insurance. By doing so, agents will become more productive, significantly impacting the insurer's bottom line.

Author: Sumanas Kar Regional Director India & South Asia Vymo Technologies

Disclaimer: The opinions expressed within this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of IIA and IIA does not assume any responsibility or liability for the same.